Why UAE expats need a legally valid UAE will

In the absence of a registered UAE will, the courts take control of major decisions. The list below shows what that can mean for your family and estate.

Inheritance follows statutory rules if no will is registered

Under UAE Civil Personal Status law, if no registered will exists, inheritance follows fixed legal rules rather than personal choice. A surviving spouse may receive only 50% of the estate, with the remainder distributed among children or other relatives.

Bank accounts are to be frozen immediately after your passing

Without a registered will, all UAE bank accounts (including joint accounts) are frozen until the court completes inheritance proceedings, a process that can take several months and leave your spouse without access to essential funds.

Guardianship of your children may be decided by the court

In the absence of a registered will, temporary and permanent guardians are appointed through a legal process based on formal rules and court discretion. Decisions focus on legal criteria and the child’s best interests, and may not reflect your wishes.

Joint property or shared assets may be held up in legal disputes

Even if you co-own property, your share can't be automatically transferred to your spouse without a valid will. This can cause delays in selling, refinancing, or even occupying the property while the courts determine rightful ownership.

Your business or investments could be left in limbo

For entrepreneurs or business owners, the death of a shareholder without a will can halt company operations, freeze corporate accounts, and trigger uncertain ownership disputes until the court appoints heirs.

Foreign wills are unlikely to be accepted for UAE assets

Differences in language, legal systems, and notarisation usually mean foreign wills are rejected or unenforceable. When this happens, UAE courts rely on local inheritance laws rather than the instructions in the foreign will.

Three steps to create and register your UAE will

Creating your will is quick and convenient – complete it online at your own pace. No office visits, no paperwork – just a simple, secure process.

Your will is submitted to the Abu Dhabi Judicial Department (ADJD) for legal validation by a court clerk

You'll be invited to a short Zoom call with an ADJD court clerk to verify your identity and complete the notarisation of your will

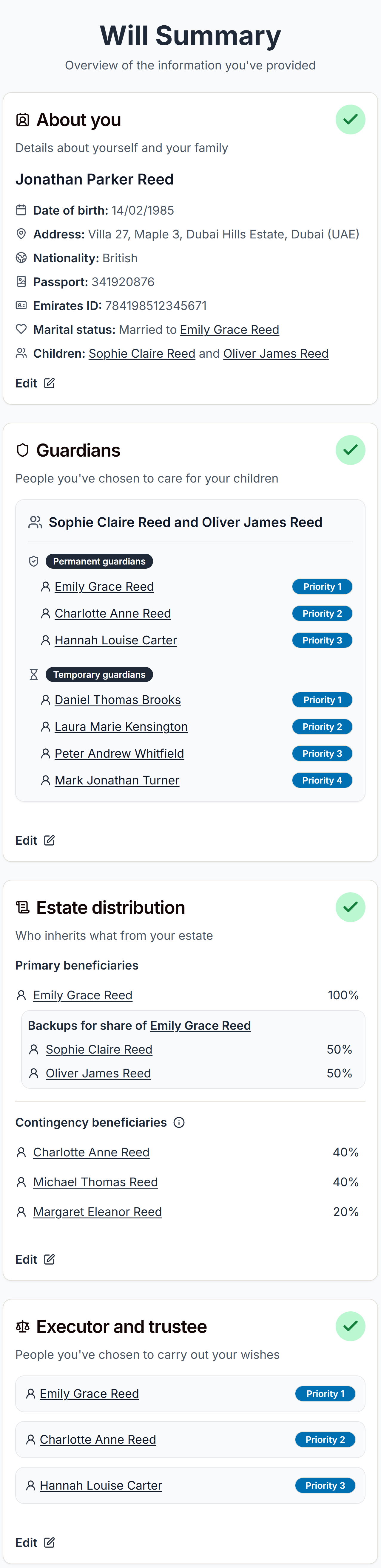

Meet our UAE specific online will platform

Our online will editor is designed specifically for UAE expats, with features tailored to local requirements.

Personal will dashboard

Create your will at your own pace. Save your progress at any time and return when you're ready to continue – your information is securely stored and waiting for you in your personal will dashboard.

Smart issue detection

Automated checks built into our questionnaire workflow flag 70+ typical oversight scenarios and potential errors to help you prepare a comprehensive, legally sound will that reflects your true intentions.

Easy role assignment

Nominate the same person to multiple roles in your will without re-entering their details. Their contact and identification information stay linked throughout, ensuring consistency and easy updates.

Secure data requests

Optionally send secure links to the people named in your will so they can enter their identification details directly, making it easy to add multiple backups for beneficiaries, guardians, and other key roles.

The superior ExpatWill.ae ADJD will template

Create your UAE will using a professionally structured, ADJD compliant will template. Explore some key features that set our template apart below.

Nominate unlimited number of primary, backup and contingency beneficiaries – assign percentage shares throughout as you see fit.

Nominate temporary and permanent guardians for your children, with unlimited backups to make sure they're always cared for by someone you trust.

Formatted to align with Abu Dhabi Judicial Department (ADJD) submission requirements and applicable UAE legal standards.

An Arabic translation of your will is included to meet local requirements, providing full legal clarity and peace of mind.

Generate your completed will PDF instantly online – no lawyers, no clunky templates, no waiting for callbacks – just a simple, efficient process.

View example will

Generated online by ExpatWill.ae

Compare will types in UAE

Non-Muslims in the UAE can register an ADJD, DIFC, or Notary Public will – each with its own legal framework, registration process, and cost.

ADJD Will

via ExpatWill.ae

ADJD Standard

Will Format

DIFC Courts

Online Will

UAE Notary

Public Will

Transparent pricing for couples and singles

No credit card or payment required until you're ready to download your populated will.

Couples will

Frequently asked questions

Everything you need to know about creating your will in the UAE.

Sharia law is the Islamic legal framework that governs matters such as inheritance, guardianship, and family affairs for Muslims in the UAE. It forms the basis of inheritance and guardianship rules for Muslim estates.

Under Sharia law, inheritance is allocated according to predetermined fixed shares, and guardianship of minor children is determined in accordance with Sharia principles. For non-Muslims, UAE civil law provides a separate framework for inheritance and guardianship. Registering an ADJD will allows your wishes to be formally recorded and recognised.

Under Sharia law, inheritance is distributed according to fixed shares set by Islamic principles. These shares depend on who survives the deceased.

- A husband inherits half of his wife’s estate if there are no children, or one-quarter if there are.

- A wife inherits one-quarter if there are no children, or one-eighth if there are.

- Sons typically receive twice the share of daughters.

Because these rules are mandatory and allow limited flexibility, many expats choose to register a will so their assets can be distributed according to their personal wishes.

Yes. UAE law provides a civil legal framework that allows expats to register wills that do not follow Sharia inheritance rules. This enables inheritance, guardianship, and succession matters to be handled as civil legal matters rather than under Sharia principles.

- Legal basis: Under Federal Decree-Law No. 41 of 2024 (Personal Status Law), a civil framework exists for matters such as inheritance and guardianship.

- What this allows: You can decide how your UAE-based assets are distributed and who should act as guardians for your children, in line with your personal wishes.

- Registration requirement: To be legally recognised and enforceable, the will must be registered with the Abu Dhabi Judicial Department (ADJD) or another approved court.

Important note: This option is available only to non-GCC expats (those who do not hold a passport from a GCC country – UAE, Saudi Arabia, Oman, Kuwait, Qatar, or Bahrain). UAE and other GCC nationals remain subject to Sharia-based inheritance rules and cannot register wills under the civil family law framework.

Yes. If you are a non-GCC Muslim expat, you can register a will under the UAE’s civil family law framework, allowing matters such as inheritance, guardianship, and succession to be handled as civil legal matters, rather than under Sharia rules.

- Jurisdiction: The Abu Dhabi Judicial Department (ADJD) Civil Family Court accepts non-Sharia will registrations from non-GCC expats, regardless of religion.

- What the Civil Family Court is: The ADJD Civil Family Court is a specialised court that applies civil law rather than religious law for eligible foreigners. In this context, "civil" means the court applies UAE legislation equally, without reference to religious affiliation.

- Eligibility: Eligibility is assessed based on nationality, not religion. The ADJD Civil Family Court does not assess or take into account a person's religion when determining eligibility. What matters is whether the individual is a non-GCC national. This position is confirmed by the Abu Dhabi Judicial Department’s Civil Family Court framework (see topic "Wills → 7. Can Muslims register a Will?"), which expressly permits Muslims to access civil (non-Sharia) family services, including wills.

- Legal basis: Under Abu Dhabi Law No. 14 of 2021 (Civil Family Law), non-GCC expats may opt into this framework, meaning their will is treated as a civil instrument, not a religious one.

- Enforceability: Wills registered through the ADJD Civil Family Court are legally enforceable across all seven Emirates, including Dubai, for UAE-based assets and family matters.

Important note: This option is available only to non-GCC expats (those who do not hold a passport from a GCC country – UAE, Saudi Arabia, Oman, Kuwait, Qatar, or Bahrain). UAE and other GCC nationals remain subject to Sharia-based inheritance rules and cannot register wills under the civil family law framework.

In January 2026, the UAE introduced federal legislation recognising eighteen as the age of legal adulthood. While this change applies broadly under UAE law, the court procedures used for will registration have not yet fully aligned with this update.

For the purposes of registering a will with the Abu Dhabi Judicial Department (ADJD), the court currently continues to treat 21 as the minimum age for full legal capacity when making a will.

This approach also applies to related provisions commonly included in wills, such as guardianship arrangements and the holding of assets in trust for beneficiaries. As a result, wills prepared for ADJD registration continue to follow the existing court-applied age threshold.

Most couples choose to make wills for both partners, particularly when there are children involved. This is because a will only records the wishes of the person who made it and cannot cover assets or instructions for the other partner.

Even if one spouse or partner does not currently own assets in their own name in the UAE, circumstances can change over time. Assets, income, or entitlements may be acquired later. Having a will in place helps both partners be prepared for future circumstances.

Where property or bank accounts are held jointly, it is also important to understand that these are not automatically transferred to the surviving spouse or partner if either passes away. Joint bank accounts are typically frozen as part of the standard legal and banking process, and jointly owned property does not automatically pass to the surviving spouse or partner.

Where children are involved, courts also look to the intentions of both parents when considering guardianship. Having wills in place for both partners helps provide a complete and aligned set of instructions.

In addition to the above, couples often choose to make wills for both partners to cover the scenario where both pass away at the same time or in close succession. Each person’s will can only deal with their own estate. Having wills in place for both partners helps avoid gaps where assets or guardianship arrangements might otherwise be left to default legal rules.

If a foreign resident passes away in the UAE and no legal heirs can be identified, UAE authorities will first carry out checks to confirm that there are no entitled family members or beneficiaries.

Under recent legal updates effective from January 2026, if no heirs are found, any remaining UAE-based assets may ultimately be transferred to a charitable endowment managed by the authorities. This process happens through the court system and only after all reasonable steps have been taken to locate heirs.

Abu Dhabi Judicial Department (ADJD) registration takes place after your will has been populated on ExpatWill.ae. ExpatWill.ae guides you through the necessary steps for registration, which are completed directly through the official ADJD Registration Portal.

The outline below summarises the ADJD will registration process.

| Step | What happens |

|---|---|

| 1. Access ADJD | Visit the ADJD Registration Portal and authenticate using your UAE Pass |

| 2. Input details | Complete the online will registration request and upload your signed ExpatWill.ae PDF file |

| 3. Legal validation | An ADJD court clerk shall perform a legal validation of your will |

| 4. Court fee payment | ADJD shall email you a payment link for the will registration fee (currently AED 950) |

| 5. Video notarisation | You shall attend an ADJD video call to verify your identity and have your will notarised |

| 6. Issuance | ADJD shall add their official notarisation stamp to your will and send you a copy via email |

| 7. Court record filing | Your notarised will shall be filed and retained within the official ADJD court records |

The end-to-end ADJD registration process typically takes around three to five business days.

In most cases, minor changes to personal details – such as a new passport number or updated address – do not require your will to be updated, provided the person can still be clearly identified.

It may be appropriate to review your will if:

- Your legal name changes

- Your nationality changes

- Your marital status changes

- You wish to make changes to the individuals appointed, or to the roles or shares assigned to them

- A nominated person can no longer be clearly identified based on the information recorded in the will

As a general rule, if a change could create uncertainty about identity or intent, updating your will helps avoid delays or questions during court processing.

ExpatWill.ae allows you to update your will online at any time. If an updated version is created, it must be re-registered with ADJD for the changes to take legal effect.

If you move out of the UAE, your UAE-registered will generally remain valid and continues to have legal effect in relation to assets located in the UAE.

However, relocating can affect your wider estate planning. You may wish to review your will if your country of residence or family circumstances change, or if you create a will in another country.

Ready to protect your family's future?

Create a UAE recognised will at your own pace, using a structured process designed specifically for expat families.

Secure and confidential • Trusted by UAE expats